However, how this information is presented depends on whether a company uses the “direct method” or “indirect method” for operating cash flows. Under the direct method, these cash inflows from customers and outflows to employees and suppliers are presented as such. Cash flows are analyzed using the cash flow statement, a standard financial statement that reports a company’s cash source and use over a specified period. Corporate management, analysts, and investors use it to determine how well a company earns to pay its debts and manage its operating expenses. The cash flow statement is an important financial statement issued by a company, along with the balance sheet and income statement.

To find your cash flow value, subtract the outflow total from step 3 from the total cash balance from steps 1 and 2. This final number will also be the opening balance for your next month or operating period. While cash flow from operations should usually be positive, cash flow from investing can be negative, as it shows that a business is actively investing in its long-term health and development. Investments can include physical assets like equipment or property and securities like stocks and bonds. Analysts use the cash flows from financing section to determine how much money the company has paid out via dividends or share buybacks. It is also useful to help determine how a company raises cash for operational growth.

Pay your bills as soon as possible

Although it might sound like an income statement covers the same material as a cash flow statement, a company’s profits and its cash inflows can actually look very different. That sale would show up as revenue and contribute to profits on the income statement, but might not translate into a cash inflow until a later period. The operating activities section of a cash flow statement summarizes cash inflows and outflows involved with running the business itself. Inflows might include cash received from customers, and outflows might include cash paid to suppliers and employees. While positive cash flows within this section can be considered good, investors would prefer companies that generate cash flow from business operations—not through investing and financing activities.

One option is to adjust prices upward on goods that are in high demand or for which there are no competing products, since this increases the profit and cash flow generated from each sale. Another option is to concentrate purchases with a smaller number of suppliers, if doing so qualifies the company for volume purchase discounts. Also, consider redesigning products to use common parts, so that the company can reduce its investment in different types of inventory. Yet another possibility is to outsource production, so that the company no longer has to invest in raw materials or work-in-process inventory.

Cash Flow Statement

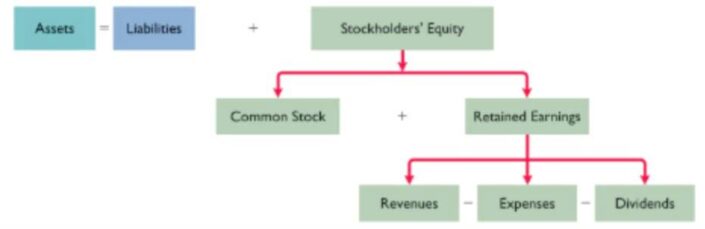

Finally, consider tightening the company’s credit policy, so that customers must pay within a shorter period of time, and the amount of credit granted is restricted for customers in more difficult financial situations. These actions will have a positive effect on the cash flows generated by a business. A company’s 3 main financial statements are the cash what is cash flow flow statement, the balance sheet, and the income statement. Each document provides a different perspective on the company’s financial positioning and business performance, so it’s a good idea to look at all 3 to get a more complete picture of how the company is doing. Cash flow is the net cash and cash equivalents transferred in and out of a company.

Cash flow is typically reported in the cash flow statement, a financial document designed to provide a detailed analysis of what happened to a business’s cash during a specified period of time. The document shows different areas where a company used or received cash and reconciles the beginning and ending cash balances. Free cash flow shows a company’s ability to generate cash above its operating and investing needs. Free cash flow is used to measure whether a company has enough cash, after funding operations and capital expenditures, to pay its creditors and equity investors through debt repayments, dividends, and share buybacks. To calculate FCF, we would subtract capital expenditures from cash flow from operations. In contrast, direct cash flow statements leave out the non-cash aspects of your cash flow from operations.